Seoul shares end slightly up ahead of U.S. Fed meeting

SEOUL, Aug. 21 (Yonhap) -- South Korean stocks closed slightly higher Wednesday amid what analysts here called the lack of any event to clearly move the market in either direction while foreigners again turned to selling. The Korean won continued to gain ground against the U.S. dollar.

The benchmark Korea Composite Stock Price Index (KOSPI) gained 4.40 points, or 0.22 percent, to close at 1,964.65. Trading volume was moderate at 382 million shares worth some 3.74 trillion won (US$3.11 billion), with winners outnumbering losers 554 to 256.

Investors remained cautious ahead of the Jackson Hole Fed meeting, slated to be held from Thursday to Saturday (U.S. time), where Fed Chairman Jerome Powell is expected to offer a message suggesting the future direction of U.S. monetary policy.

"South Korean stocks closed higher on hopes of U.S.-China trade negotiations. However, the rise stayed range-bound amid a clear wait-and-see attitude of investors ahead of the Jackson Hole Fed meeting and the release of the Federal Open Market Committee (FOMC) minutes," Seo Sang-young, an analyst at Kiwoom Securities, said.

Normally, the minutes from the FOMC meeting are a barometer of the future direction of rate policy, but Samsung Futures analyst Jeon Seung-ji insisted the market will likely pay more attention to a message from Powell.

"The Fed is set to release the minutes from its latest Federal Open Market Committee minutes, but the market is paying more attention to whether there have been any changes to the perception of Chairman Powell since (the FOMC meeting) as there have been many changes in conditions, including additional U.S. tariffs on Chinese imports," Jeon said.

The Fed slashed its base rate by 25 basis points to a range of 2.0 percent and 2.25 percent in its latest FOMC meeting last month, marking the first U.S. rate cut in more than a decade, but Powell earlier said the latest cut did not signal the start of a long series of rate reductions.

The next FOMC meeting is set to be held from Sept. 17-18.

Foreign investors sold a net 129 billion won, one day after they ended a selling streak of 13 consecutive sessions to become net buyers.

Individuals scooped up a net 102 billion won, while institutions purchased a net 5.7 billion won.

Large caps closed mixed.

Market kingpin Samsung Electronics added 0.11 percent to 44,500 won, but No. 2 chipmaker SK hynix lost 0.79 percent to 75,800 won, with top automaker Hyundai Motor also shedding 0.79 percent to 125,500 won.

Top chemical maker LG Chem closed 1.23 percent higher at 328,000 won, while leading pharmaceutical company Celltrion advanced 0.97 percent to 156,500 won.

The local currency closed at 1,202.45 won against the dollar, up 5.85 won from the previous session's close.

bdk@yna.co.kr

(END)

-

'Queen of Tears' weaves rich tapestry of Korean contemporary art

'Queen of Tears' weaves rich tapestry of Korean contemporary art -

Indonesia coach left with mixed feelings after eliminating native S. Korea in Olympic football qualifiers

Indonesia coach left with mixed feelings after eliminating native S. Korea in Olympic football qualifiers -

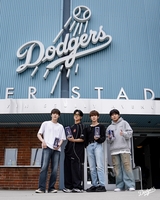

Ateez member Yunho throws first pitch at MLB match between Dodgers, Mets

Ateez member Yunho throws first pitch at MLB match between Dodgers, Mets -

N. Korea says Kim guided simulated nuclear counterattack drills for 1st time

N. Korea says Kim guided simulated nuclear counterattack drills for 1st time -

N. Korea calls envisioned U.S. aid to Ukraine 'hallucinogen'

N. Korea calls envisioned U.S. aid to Ukraine 'hallucinogen'

-

'Queen of Tears' weaves rich tapestry of Korean contemporary art

'Queen of Tears' weaves rich tapestry of Korean contemporary art -

Experts see possibility of N.K. conducting nuclear test before U.S. presidential vote

Experts see possibility of N.K. conducting nuclear test before U.S. presidential vote -

N. Korea says Kim guided simulated nuclear counterattack drills for 1st time

N. Korea says Kim guided simulated nuclear counterattack drills for 1st time -

Looming weekly closure of major hospitals feared to worsen medical service crisis

Looming weekly closure of major hospitals feared to worsen medical service crisis -

N. Korea calls envisioned U.S. aid to Ukraine 'hallucinogen'

N. Korea calls envisioned U.S. aid to Ukraine 'hallucinogen'

-

Indonesia coach left with mixed feelings after eliminating native S. Korea in Olympic football qualifiers

Indonesia coach left with mixed feelings after eliminating native S. Korea in Olympic football qualifiers -

N. Korea denounces U.S. condemnation of human rights violations

N. Korea denounces U.S. condemnation of human rights violations -

S. Korea eliminated in Olympic football qualifiers as poor defense, undisciplined play prove costly

S. Korea eliminated in Olympic football qualifiers as poor defense, undisciplined play prove costly -

(LEAD) Blinken calls on China to press N. Korea to end its 'dangerous' behavior

(LEAD) Blinken calls on China to press N. Korea to end its 'dangerous' behavior -

S. Korea, U.S. lay out respective visions for new defense cost-sharing deal: U.S. negotiator

S. Korea, U.S. lay out respective visions for new defense cost-sharing deal: U.S. negotiator