Property developer signs deal to acquire Eastar

SEOUL, June 24 (Yonhap) -- South Korean property developer Sung Jung Co. has signed an agreement with Eastar Jet Co. to acquire the financially troubled budget carrier, paving the way for it to resume flights within this year, the companies said Thursday.

Sung Jung signed the deal to acquire an 80 percent stake in Eastar for about 110 billion won (US$97 million), with the condition that it will maintain the carrier's current workforce for the next five years, Eastar Chief Executive Kim You-sang said.

Eastar plans to submit its debt-repayment and other rehabilitation plans to the Seoul Bankruptcy Court by July 20, which was delayed by two months.

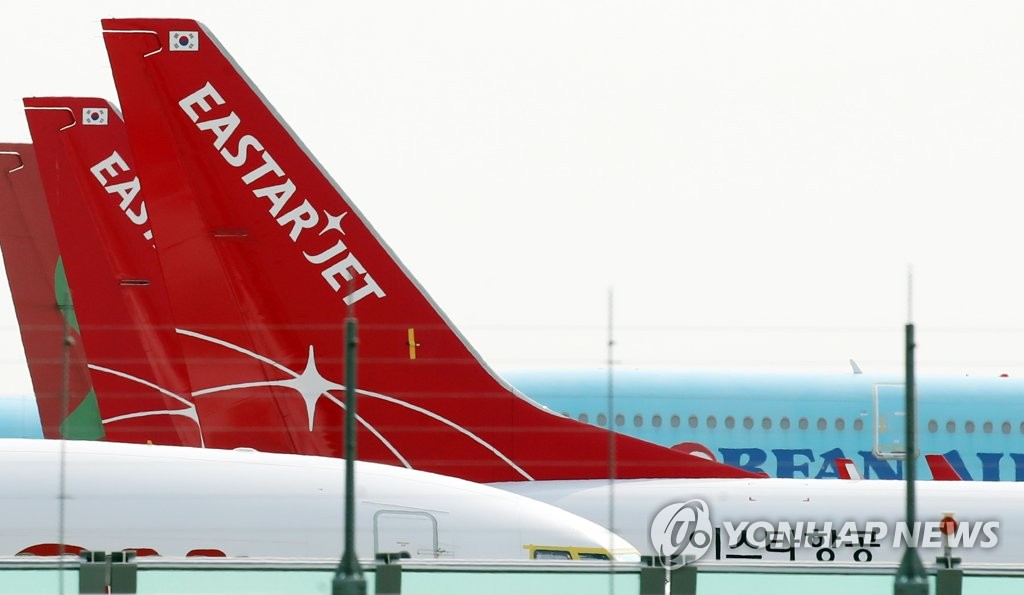

This photo taken on June 23, 2021 shows Eastar Jet's planes at the Incheon International Airport in Incheon, just west of Seoul. (Yonhap)

Sung Jung was picked as a preliminary preferred bidder for Eastar ahead of an open auction and given the preferred rights to buy the carrier. It had offered 100 billion won for the Eastar takeover.

In last week's auction, a consortium led by local underwear company Ssangbangwool, Inc. attended as sole bidder with a price tag of 108.7 billion won.

Sung Jung, the stalking horse bidder, notified the court that it will pay the higher price to become the new owner of the carrier, and the court accepted it.

The court selected the Ssangbangwool consortium as secondary bidder for the low-cost carrier.

Unlike the Ssangbangwool consortium, which needs to team up with financial investors to acquire Eastar, Sung Jung said it is able to fund the deal with its own cash.

In the stalking horse bid, Eastar picked Sung Jung as the preliminary bidder ahead of the auction, in which other bidders submitted their prices.

If a company submits a bidding price that is the highest and higher than the stalking horse's price in the auction, the company will ask the stalking horse if it can pay the highest bidding price to buy Eastar.

The carrier has said it aims to receive an air operator certificate (AOC) from the transport ministry once the Seoul bankruptcy court accepts its rehabilitation program to resume domestic flights as early as November.

Eastar has suspended most of its flights on domestic and international routes since March last year due to the coronavirus' impact on the airline industry, and its AOC became ineffective in May 2020.

It has had difficulties in finding a strategic investor since July last year, when Jeju Air Co. scrapped its plan to acquire the carrier amid the prolonged COVID-19 pandemic.

In January, Eastar Jet applied for court receivership to find a way to continue its air transport business through M&A procedures.

The court approved the corporate rehabilitation process for the carrier in the following month.

The court later ordered preservation measures and comprehensive prohibition to prevent creditors from seizing or selling company assets and to freeze all bonds before the carrier's rehabilitation proceedings.

kyongae.choi@yna.co.kr

(END)

-

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight -

Ex-PM suffers crushing defeat

Ex-PM suffers crushing defeat -

Man in his 40s nabbed for spray-painting slurs toward ex-President Moon

Man in his 40s nabbed for spray-painting slurs toward ex-President Moon -

Police catch 1,681 over alleged election law violations

Police catch 1,681 over alleged election law violations -

PPP lawmaker says entire Cabinet should resign over general elections defeat

PPP lawmaker says entire Cabinet should resign over general elections defeat

-

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight -

Ruling party leader resigns following election defeat

Ruling party leader resigns following election defeat -

(LEAD) Yoon vows to improve communication with people after election defeat

(LEAD) Yoon vows to improve communication with people after election defeat -

N.K. leader vows to deal 'death-blow' to enemy in event of confrontation: KCNA

N.K. leader vows to deal 'death-blow' to enemy in event of confrontation: KCNA -

Yoon presides over emergency meeting on Mideast crisis

Yoon presides over emergency meeting on Mideast crisis

-

N. Korea has capability to genetically engineer biological military products: U.S. report

N. Korea has capability to genetically engineer biological military products: U.S. report -

(LEAD) S. Korea 'strongly' protests Tokyo's renewed claims to Dokdo, calls in Japanese diplomat

(LEAD) S. Korea 'strongly' protests Tokyo's renewed claims to Dokdo, calls in Japanese diplomat -

(LEAD) Yoon vows to improve communication with people after election defeat

(LEAD) Yoon vows to improve communication with people after election defeat -

(3rd LD) U.S. unveils US$6.4 bln in CHIPS Act grants to Samsung Electronics

(3rd LD) U.S. unveils US$6.4 bln in CHIPS Act grants to Samsung Electronics -

(2nd LD) Yoon apologizes for failing to heed people's will following election defeat

(2nd LD) Yoon apologizes for failing to heed people's will following election defeat